Are you looking for a reliable credit card with unparalleled rewards? With a Bank of Montreal Credit Card, you can enjoy perks, privileges and more. Bank of Montreal offers a range credit cards designed to complement your lifestyle. If you are looking to earn rewards with every swipe, you have come to the right place. Read on to find out how you can apply for a Bank of Montreal credit card today.

Bank of Montreal Credit Card Features and Benefits

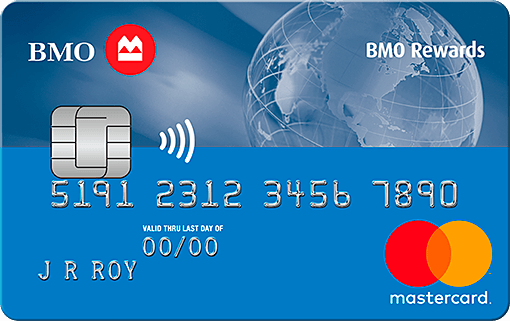

To gain a deeper understanding of the wide range of privileges you can gain with a Bank of Montreal credit card, let’s take a closer look at the Rewards MasterCard today.

The Bank of Montreal Rewards MasterCard stays true to its name. It gives you rewards points unlike any other. Here, you can earn up to 20,000 BMO rewards welcome points when you open an account. You can get a further 10,000 welcome points after your first card purchase and an additional 10,000 points when you spend $1,000 in the first 3 months of opening your account.

Likewise, you can earn 1 BMO Rewards point for every $1 you spend on your credit card. You can get additional rewards points faster when you bring in supplementary cardholders!

As a Rewards MasterCard holder, you can earn double the rewards when you use your card at participating National Car Rental and Alamo Rent-a-Car locations nationwide! This is perfect if you are travelling from one place to another.

Use these rewards towards for travel, hotel accommodation, gadgets, and lifestyle packages! With this card, the possibilities are endless.

Applying for a Bank of Montreal Credit Card

Applying for a Bank of Montreal Credit Card is more accessible than ever. All you need to do is fill out the online application form and you can immediately see if you are eligible for your desired card. For more information, visit the Bank of Montreal website here.

To be eligible, you need to be the age of majority in your province or in your territory and have not declared bankruptcy in the last 7 years. If you are new to Canada, feel free to book an appointment and visit a Bank of Montreal bearing a valid proof of address and proof of identification. Other documents you may need to prepare include verification of employment.

If your application is approved, you will be given a credit limit ranging from $500 to $3,000 depending on your creditworthiness.

Bank of Montreal Credit Card Fees and Charges

There are NO annual fees for the Bank of Montreal Rewards MasterCard. You’ll be glad to know that supplementary cards are free as well.

Other charges you need to remember include the 19.99% annual interest rate for purchases, 22.99% annual interest rate for balance transfers (after the promotional interest rate of 1.99% for the first 9 months), and a 22.99% annual interest rate on cash advances.

Some fees you need to be aware of include the $29 over limit fee and $5 cash advance fee.

Bank of Montreal’s Address & Contact Details

Address: 119, Rue Saint-Jacques Montreal, QC H2Y1L6

To get in touch with Bank of Montreal, call 1-844-837-9228.

Conclusion

Overall, if you’re looking for a rewarding every day credit card a Bank of Montreal Credit Card, particularly the Rewards MasterCard is the answer. With their great rewards program, you’ll feel fulfilled with every swipe of your card. Apply now!

Note: There are risks involved when applying for and using a credit card. Please see the bank’s Terms and Conditions page for more information.