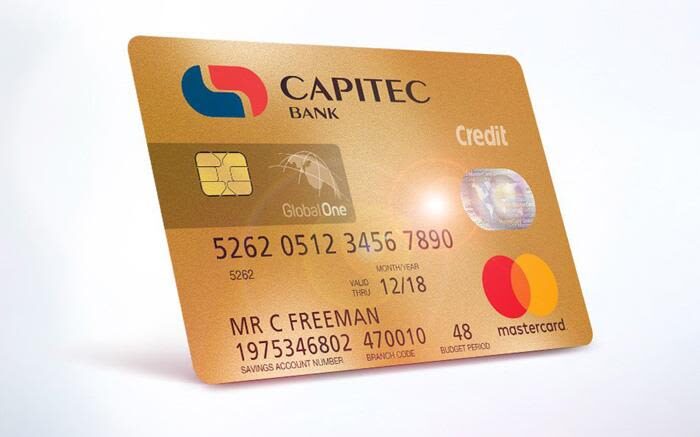

Looking for a personal loan that you can use almost immediately after your application gets approved? Look no further as Capitec Bank has a variety of selections that fit your requirements.

Some of their most popular loans are mortgage, commercial property, trade finance, and credit cards. Capitec offers a competitive rate for personal loans, starting at just 12.9% per annum.

If you want to find out how to apply for a loan online, take a look at what the company has to offer.

Capitec Online Personal Loan Features and Benefits

With Capitec Online’s Personalised Loans, you can borrow money for any purpose including home improvement, travel, medical emergencies and education expenses. This way, you can finance your needs no matter how big or small they are.

What’s better is that Capitec Bank makes getting loans a much convenient experience because you can get your money in just a matter of minutes.

Perhaps the significant benefit of the Capitec personal loan is that the offer is completely tailored to your needs, so you get the best interest rate.

The loan is also highly predictable since you will have to make your payments in fixed amounts during the whole term. Based on your credit history and income, you can qualify for only 12.9% APR.

The loan amount is also flexible, so you can loan up to R 250,000. So, no matter your plans, a Capitec bank loan is one of the best choices.

Another benefit is that it is very simple to apply online. It takes just a few minutes to be approved for your loan, and the money is available immediately.

Capitec also offers short-term and long-term loans, and you can manage your credit easily using the app.

Apply For A Capitec Online Personal Loan

You can get your hands on this card through various application methods including the online form on the Capitec website, using their mobile app, via a personal bank visit or you can simply give them a call.

The bank will consider your credit and banking background, as well as the value and stability of your income. Your application will also be evaluated based on your expenses including mortgage payments.

Files you need to present include an original copy of an identification document and proof of residential address.

Keep in mind that your name should be consistent across all the documents you present, otherwise, you will be required to submit a document justifying the difference. This includes a marriage certificate, a court order or a name change certification. You should also have your latest salary slip and an original bank statement on hand.

During your application, you will need to specify the loan amount and term. The company also gives you the liberty to choose the monthly installment that best fit your lifestyle and income. In fact, you can even choose the best offer that can give you the most competitive interest rate.

Fees and Charges

Successfully applying for this loan gets you a favourable interest rate starting from 12.9% to 27.75%.

The institution provides a range of interest rates depending on the loan term and amounts including the following.

- R25,000 for 12 months (12.9% to 27.75%)

- R50,000 for 24 months (12.9% to 27.75%)

- R100,000 for 48 months (14.2% to 27.4%)

- R250,000 for 64 months (16.3% to 21.7%)

The best thing about this loan is its fixed repayment schedule. This allows you to manage your loan with much ease as your monthly payments are predictable.

Just keep in mind that there is a once-off initiation fee which is R 1,207.50. Moreover, a monthly service fee of R 69 applies to all loans.

Bank Contact Info

If you need help or you want some more information about this card, you can contact Capitec with the following details.

Address: Quantum Street, Techno Park, Stellenbosch, 7600

Phone Number: 021 941 1377 or 0860 66 77 89

Fax: 021 941 0770

Email: clientcare@capitecbank.co.za

Summary

You can never go wrong with a Capitec Online Personal Loan. Whatever your needs are, Capitec has you covered, so what are you waiting for?

Jumpstart the process by using one of their convenient and fast application methods and you will surely have your loan in no time.

Note: There are risks involved when applying for and using credit. Consult the bank’s terms and conditions page for more information.